Clippers president Andy Roeser will handle day to day operations of the club for now, according to a person familiar with the situation.

The person spoke to USA TODAY Sports on condition of anonymity because the sensitivity of the situation.

"The central findings of the investigation are that the man whose voice is on the recordings ... is Mr. Sterling and that the hateful feelings are those of Mr. Sterling. The views expressed by Mr. Sterling are deeply disturbing and alarming," Silver said during a news conference Tuesday.

"As for Mr. Sterling's ownership interest in the Clippers," Silver said. "I will urge the board of governors to force a sale of the team and will do everything in my power to ensure that happens."

PLAYERS: Full support of Silver's decision

TWITTER: NBA community reacts to news

Silver said he made the decision to ban Sterling Tuesday morning and that he will begin immediately the process of trying to get Sterling to sell the team.

"This has been a painful moment for all members of the NBA family," Silver said.

Sliver said he didn't poll the owners, but did speak to several who he said supports the decision.

"The owners have the authority subject to three-quarters vote, to remove him as owner," Silver said.

Silver said that he will push owners to vote on the matter quickly. Sentiment from owners is starting to come out.

"On behalf of the Miller family, we support the decisive action by Commissioner Silver and the NBA to reaffirm that there is no place for racism and hatred in our league," said Greg Miller. CEO of the Larry H. Miller Group, owner of the Utah Jazz. "The Jazz organization and all the teams in the NBA should act as national leaders in promoting inclusiveness and diversity. We have a responsibil! ity in our communities to fight against discrimination and ignorance and showcase sports as an example of respect and tolerance. While this situation has been inexcusable, I hope it serves the greater purpose of reinforcing our vigilance against this type of behavior."

STATEMENT: Listen to and read Silver's comments

OFFICIAL RELEASE: Silver's decree laid out with specifics

"I commend Commissioner Adam Silver in being diligent in how he handled this important matter," said Atlanta Hawks majority owner Bruce Levenson, who had already said he would vote to remove Sterling if a vote was taken. "He acted swiftly and appropriately with the severity of the penalty and I strongly support his decision."

The fine will be donated to organizations dedicated to anti-discrimination and tolerance efforts that will be jointly selected by the NBA and the Players Association, Silver said.

NBA Commissioner Adam Silver announced Clippers owner Donald Sterling's punishment, which included banning him for life from the NBA and a $2.5 million fine.

Kevin Johnson, the Sacramento mayor and former NBA All-Star, expressed his support for Silver.

"The players spoke, they acted, and they were listened to," said Johnson, who is working for the players association at the request of Chris Paul, the Clippers guard and president of the union. "On this day, Adam Silver is not only the owners' commissioner, he is the players' commissioner and we're proud to call him our commissioner."

In Silver's first seminal moment as commissioner since taking over for David Stern in February, he issued the heaviest penalty possible under his power, which is governed by the NBA's private constitution and bylaws.

Sponsors began pulling out Monday and Silver said marketing partners should judge NBA based on league's response to Sterling incident.

Promising a quick investigation, Silver said Sterling confirmed his is the voice on the audio and said the recording was not tampered with, as the Clippers suggested was possible in a statement on Saturday.

CLIPPERS: Rivers is perfect coach for moment

BUSINESS: Sterling storm hurts NBA in pockets

Comments by Sterling surfaced Saturday when TMZ posted the audio recording on its web site. In a conversation between he and a female friend, he chastised the woman for posting pictures of herself on Instagram with minorities, including Basketball Hall of Famer Magic Johnson and Los Angeles Dodgers outfielder Matt Kemp.

"Why are you taking pictures with minorities, why?" Sterling said.

He continued: "Don't put him on an Instagram for the world to have to see so they have to call me. … And don't bring him to my games, OK? ...

"Yeah, it bothers me a lot that you want to promo, broadcast that you're associating with black people. Do you have to?" Sterling said.

"When I first heard the comments I was hoping it was doctored and hoping it wasn't Donald," Silver said. "I've known Donald for over 20 years.

"I haven't been that close to him, but never seen anything tha! t would indicate that he held the views that were expressed in these audio tapes."

GALLERY: Donald Sterling through the years

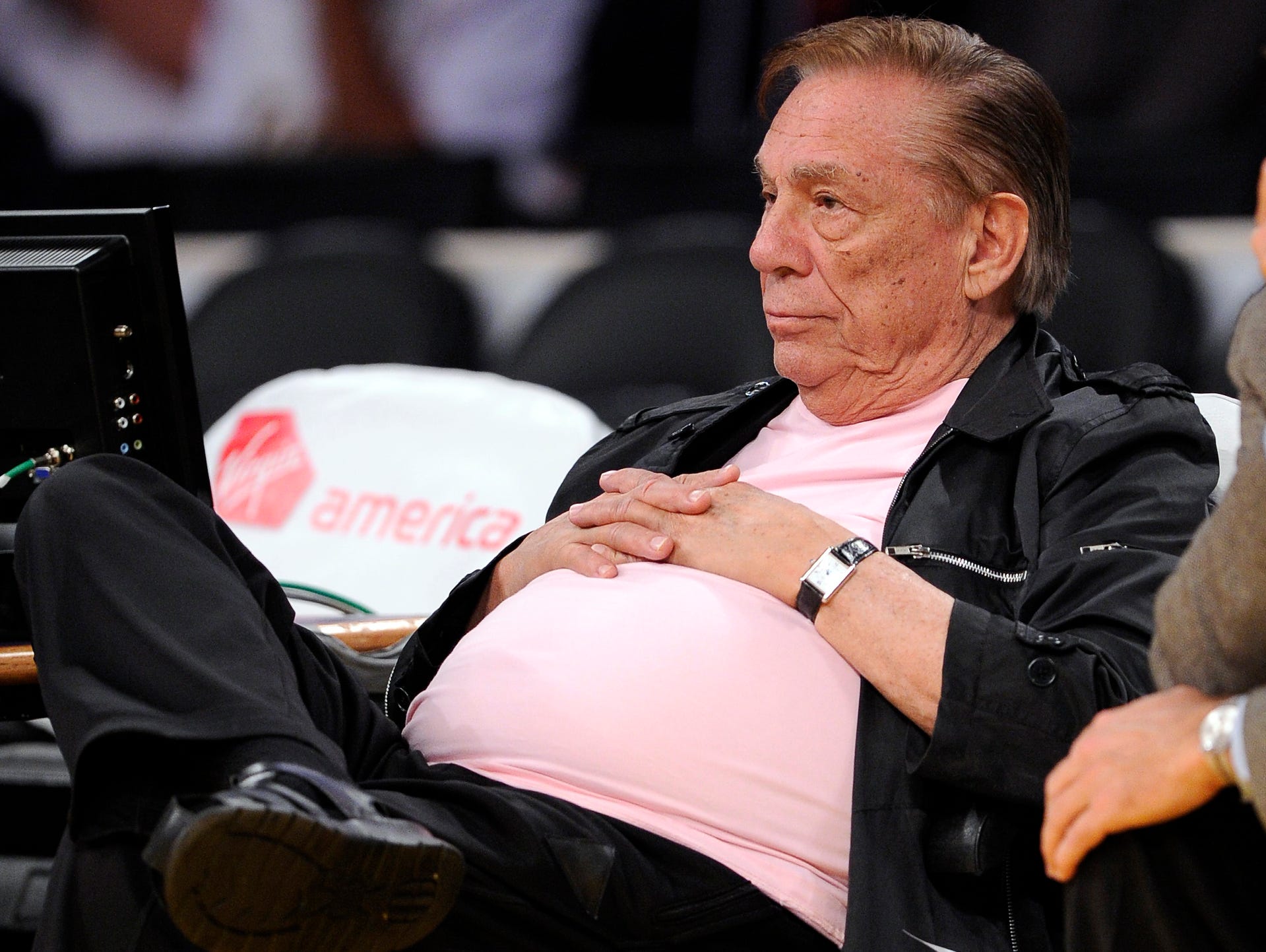

Longtime Clippers owner Donald Sterling, shown in 2010, has been banned by the NBA. Flip through this gallery for more of Sterling. (Photo: Mark J. Terrill, AP)View Fullscreen

Longtime Clippers owner Donald Sterling, shown in 2010, has been banned by the NBA. Flip through this gallery for more of Sterling. (Photo: Mark J. Terrill, AP)View Fullscreen Sterling and former Los Angeles mayor Tom Bradley pose for a photo in 1987. (Photo: Andrew D. Bernstein, NBAE/Getty Images)View Fullscreen

Sterling and former Los Angeles mayor Tom Bradley pose for a photo in 1987. (Photo: Andrew D. Bernstein, NBAE/Getty Images)View Fullscreen A portrait of Sterling, who also is a real estate entrepreneur, as he holds a mug and stands near a deck chair in Malibu, Calif., June 1989. (Photo: Rob Lewine, Time & Life Pictures/Getty Image)View Fullscreen

A portrait of Sterling, who also is a real estate entrepreneur, as he holds a mug and stands near a deck chair in Malibu, Calif., June 1989. (Photo: Rob Lewine, Time & Life Pictures/Getty Image)View Fullscreen Sterling sits courtside during a game in 2010. (Photo: Danny Moloshok, AP)View Fullscreen

Sterling sits courtside during a game in 2010. (Photo: Danny Moloshok, AP)View Fullscreen Sterling and LaLa Vazquez sit next to each other at a Clippers-Nuggets playoff game, where Vazquez's future husband, Carmelo Anthony, starred for Denver. (Photo: Garrett Ellwood, NBAE/Getty Images)View Fullscreen

Sterling and LaLa Vazquez sit next to each other at a Clippers-Nuggets playoff game, where Vazquez's future husband, Carmelo Anthony, starred for Denver. (Photo: Garrett Ellwood, NBAE/Getty Images)View Fullscreen Sterling and former GM Elgin Baylor pose after Baylor, who later sued the team for wrongful termination, won the 2005-06 NBA Executive of the Year Award. (Photo: Andrew D. Bernstein, NBAE/Getty Images)View Fullscreen

Sterling and former GM Elgin Baylor pose after Baylor, who later sued the team for wrongful termination, won the 2005-06 NBA Executive of the Year Award. (Photo: Andrew D. Bernstein, NBAE/Getty Images)View Fullscreen Sterling smiles during the first round of the 2012 playoffs, when the Clippers beat the Grizzlies. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen

Sterling smiles during the first round of the 2012 playoffs, when the Clippers beat the Grizzlies. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen Sterling and wife Shelly attend a game in November 2013. (Photo: Kirby Lee, USA TODAY Sports)View Fullscreen

Sterling and wife Shelly attend a game in November 2013. (Photo: Kirby Lee, USA TODAY Sports)View Fullscreen Sterling sits courtside at a December 2012 game. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen

Sterling sits courtside at a December 2012 game. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen Sterling greets fans during December 2012. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen

Sterling greets fans during December 2012. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen Sterling takes in player introductions during the 1997 playoffs, when his team lost to the Jazz. (Photo: Robert Hanashiro, USA TODAY Sports)View Fullscreen

Sterling takes in player introductions during the 1997 playoffs, when his team lost to the Jazz. (Photo: Robert Hanashiro, USA TODAY Sports)View Fullscreen Sterling has a laugh with former Clippers star Elton Brand in 2001. (Photo: Catherine Steenkeste, NBAE/Getty Images)View Fullscreen

Sterling has a laugh with former Clippers star Elton Brand in 2001. (Photo: Catherine Steenkeste, NBAE/Getty Images)View Fullscreen Sterling talks with former Clippers star Lamar Odom before a 2000 game. (Photo: Robert Hanashiro, USA TODAY Sports)View Fullscreen

Sterling talks with former Clippers star Lamar Odom before a 2000 game. (Photo: Robert Hanashiro, USA TODAY Sports)View Fullscreen Sterling and former NBA commissioner David Stern meet with officials before a Clippers 2012 second-round playoff game vs. the Spurs. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen

Sterling and former NBA commissioner David Stern meet with officials before a Clippers 2012 second-round playoff game vs. the Spurs. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen Sterling and wife Shelly pose for a photo before a 2012 playoff game. (Photo: Andrew D. Bernstein NBAE/Getty Images)View Fullscreen

Sterling and wife Shelly pose for a photo before a 2012 playoff game. (Photo: Andrew D. Bernstein NBAE/Getty Images)View Fullscreen Sterling during the 2012 NBA playoffs. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen

Sterling during the 2012 NBA playoffs. (Photo: Jayne Kamin-Oncea, USA TODAY Sports)View Fullscreen Sterling in Nov. 2012. (Photo: Mark J. Terrill, AP)View FullscreenLike this topic? You may also like these photo galleries:Replay

Sterling in Nov. 2012. (Photo: Mark J. Terrill, AP)View FullscreenLike this topic? You may also like these photo galleries:ReplayThe comments drew strong criticism and outrage from players, owner, civil rights activists and public officials, including President Obama.

Several prominent players, coaches and owners, including LeBron James, Doc Rivers and Michael Jordan professed confidence in Silver.

During the news conference, Magic Johnson sent out a series of tweets:

"Commissioner Silver showed great leadership in banning LA Clippers owner Donald Sterling for life."

"Former and current NBA players are very happy and satisfied with Commissioner Silver's ruling."

"Now the Clippers players and fans can concentrate on the game tonight against the Warriors with Commissioner Silver's decision."

"Current and former NBA players now know that in Commissioner Adam Silver we have a great leader leading our league."

"Now let's hope that the other 29 owners do the right thing."

"The people who I'm happiest for are Coach Doc Rivers, the Clippers players and fans."

Lakers guard Steve Nash responded to the decision.

"I think today is a very proud moment...it begs a bigger question: if racism is a learned behavior, how long will it go on for?" he said.

"Hopefully we can see out Adam Silver's decision today and make this as quick a resolution as possible."

UNION: Johnson on players demands in advance

CLIPPERS: Should protest Sterling by winning

Sacramento mayor Kevin Johnson, who is heading the National Basketball Players Associations' search for a new executive director, has taken a lead role on behalf of the players' union.

He outlined five actions he and players wanted to see from Silver and the NBA, and late Monday, Johnson wrote on Facebook that Sterling "should be suspended indefinitely, banned from games, slapped with the maximum fine possible, and forced to extract himself from basketball operations. He should be required to name someone from his executive team or family to take over all duties relate! d to the ! Clippers..

While Sterling's comments have dominated the news, basketball insiders were not surprised. In 2005, Sterling, a real estate tycoon, agreed to pay an undisclosed amount in a lawsuit that alleged Sterling tried to force non-Koreans out of apartments in Koreatown. In 2009, Sterling paid a then-record $2.73 million Justice Department penalty for rental housing discrimination.

Sterling bought the Clippers in 1981 and is the NBA's longest tenured owner

The Clippers, who are middle of a tight 2-2 first-round playoff series against the Golden State Warriors, are in the middle of a controversy they didn't want or need. Rivers, and this is no surprise, turned into an admirable spokesperson for the Clippers.

OWNERS: At least one says he'd vote to oust Sterling

KAREEM: Sterling 'handmaiden to the bigger evil'

"I would like to reiterate how disappointed I am in the comments attributed to (Sterling) and I can't even begin to tell you how upset I am and our players are," Rivers said in a statement. "(Monday), I had a meeting with the members of our organization. When you are around all these people, you realize they are just as upset and embarrassed by the situation and it does not reflect who they really are. That was what I got from all of them. They are now a part of this and they are upset at this.

"We are all trying to figure out everything as it goes and just do our best and we hope that it is the right answer. I'm still going to do my best and do what I think is best for the team and for everybody in this case. It is very difficult because there are so many emotions in this. This is a very emotional subject, this is personal.

"My belief is that the longer we keep winning, the more we talk about this. I believe that is good. If we want to make a statement - I believe that is how we have to do it. I think that is the right way to do it, but that doesn't mean we still don't wrestle with it every day and every moment. That is the difficult part."

In a! statement! on Saturday, the Clippers said the woman who recorded the conversation is being sued by the Sterling family, accused of embezzling $1.8 million. The statement also said the woman told Sterling she would "get even."

"Mr. Sterling is emphatic that what is reflected on that recording is not consistent with, nor does it reflect his views, beliefs or feelings. It is the antithesis of who he is, what he believes and how he has lived his life. He feels terrible that such sentiments are being attributed to him and apologizes to anyone who might have been hurt by them," the Clippers said in the statement.

Sterling's comments came amid an exciting start to the NBA players and overshadowed several compelling storylines.