Introduction

Zimmer Biomet Holdings, Inc. (NYSE:ZBH) provides medical knee and hip replacement products, sports medicine, trauma products, spine products, face and skull reconstruction products, medical devices and surgical instruments, and dental products.

Zimmer Biomet has a history of subdued growth and its earnings have been volatile since the company acquired Biomet. The company is introducing new products having just received FDA clearance for a new knee system using robotics. Also Zimmer Biomet has partnered with Apple (NASDAQ:AAPL) with a new app for knee and hip replacement patients.

The company's management feels comfortable that they can generate modest earnings growth for 2020 and beyond. Over the long term the stock price could trade up but I think this would only be achieved if the company succeeds in generating its earnings growth.

The stock price is not overly expensive with a forward PE multiple of 15.6x and at book value of 2.3x. Also the stock pays a modest 0.75% dividend.

Financials

Zimmer Biomet has reported financial results for the fourth quarter of 2018 (data from Seeking Alpha and Yahoo).

The company's reported forth quarter revenue was flat over the fourth quarter of 2017. Zimmer Biomet reported diluted earnings per share loss of $4.42 compared to a profit of $6.03 reported in the fourth quarter of 2017. The EBIT was down 3.1% over the fourth quarter of 2017.

On an annual basis, revenue for 2018 was up 1.7%. Zimmer Biomet reported a full year diluted earnings per share loss of $1.86 compared to a profit of $8.90 reported for the 2017 fiscal year. Zimmer Biomet 2018 EBIT was down 14% over the 2017 fiscal year.

Zimmer Biomet paid a dividend of $0.96 for the 2018 fiscal year which was the same dividend paid for the previous two fiscal years. The current trailing yield is 0.75% and the forward yield is 0.75%.

The return on equity is not applicable at present as Zimmer Biomet booked an earnings loss for both its quarterly and annual income. Over the last decade the best return on equity was 15% which was achieved in the 2017 fiscal year. For the years with lower profits the return on equity can be down to 3%.

The profit margin is also not currently applicable for the same reason. The best profit margin of 23% was also achieved in 2017. For the years with lower profits the profit margin was down to 3%.

Zimmer Biomet's current ratio is 1.8 meaning that its current assets exceed its current liabilities. Zimmer Biomet has a history of operating with a decent amount of working capital. The current ratio has ranged from 1.5 to 3.6 over the last decade.

The asset ratio (total liabilities to total assets) is 53% which means that Zimmer Biomet's total debt is 53% of the value of everything the company owns (note that the asset value is the book value and not the liquidated value of its assets). Over the last decade Zimmer Biomet's asset ratio has ranged from 35% to 64%.

The company's book value is currently $55.25 and with a stock price of $130 Zimmer Biomet is trading at 2.3x book value.

The analysts' consensus forecast is for revenue to increase by 0.3% in 2019 and increase 2.4% in 2020. Earnings are forecast to recover in 2019 from its 2018 and then increase 6.5% in 2020. The 2020 PE ratio is 15.6x.

The financials reveal that Zimmer Biomet's debt is under control and that the company can operate efficiently when booking a decent profit.

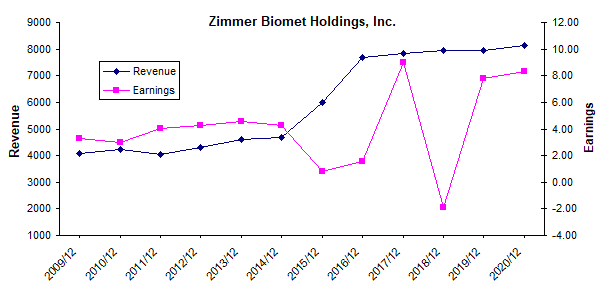

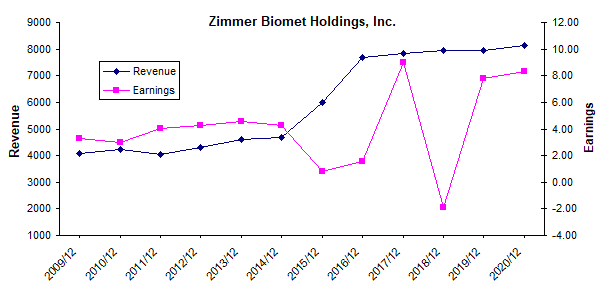

Revenue and Earnings

As an investor I personally like to examine the company's revenue and earnings history. To make this task easier and more convenient I like to visually present the data on a chart.

Zimmer Biomet data by ADVFN

The above chart visually shows Zimmer Biomet's revenue and earnings historical trend along with the next two years of consensus forecasts.

Examining the chart reveals that most of Zimmer Biomet's revenue increases occurred over the 2015 and 2016 fiscal years.

This growth surge was the result of a significant acquisition. In 2015 the company acquired Biomet for $14 billion and changed its name from Zimmer Holdings to Zimmer Biomet Holdings. The revenue and earnings for the 2015 fiscal year partly included Biomet's results and from 2016 onwards includes Biomet's full year results.

The revenue growth from 2009 to 2014 was 2.7% per year (without Biomet) and from 2016 to 2018 revenue grew at a similar rate (with biomet). The forecasts show the mild growth from 2016 continuing into 2020.

The earnings were fairly stable prior to 2014 (without Biomet) with little growth and then became volatile (with Biomet) with a loss booked for 2018. The forecasts show Zimmer Biomet's earnings recovering in 2019 with a moderate increase for 2020.

While it's just an observation, it does appear to me that the company's earnings have become volatile since it acquired Biomet. This volatility may settle down in the future and the analysts have forecast more steady earnings growth heading into 2020.

The earnings losses for 2018 were largely due to a $975.9 million Goodwill Impairment recorded on its income statement. CFO Dan Florin stated in the company's earnings call:

We recorded a one-time non-cash charge of $4.78 per share related to goodwill impairment of our Spine and EMEA reporting segments.

On an adjusted basis earnings were a profit of $2.18 per share for the quarter compared to $6.03 from the fourth quarter of 2017. Even though it's a profit, it's still down from the previous corresponding quarter.

After the company's quality control and supply chain issues, Zimmer Biomet's new CEO, Bryan Hanson, who was appointed in December 2017, is looking to drive the company forwards. As he stated in the company's earnings call:

Once we stabilize the business and have begun to deliver 2% to 3% growth in 2020 we will be well-positioned to execute against a 5-year plan that will accelerate our revenue growth, drive margin expansion, and increase free cash flow.

There's no point in dwelling on the past. As investors, it's going forwards that matters. The revenue growth in the past has been subdued with volatile earnings.

The company is introducing new products. The company has just received FDA clearance for a new knee system using robotics and they will likely receive FDA clearance of Rosa Spine. Zimmer Biomet is continuing its endeavor into digital technology having partnered with Apple. The mymobility app is being trialed on knee and hip replacement patients for their care requirements after surgery.

In a society were obesity is increasing, the requirement for Knee and hip replacements will also increase, and this will directly benefit Zimmer Biomet. Also knee injuries become more common with people who enjoy active lifestyles, especially those who are sports-oriented. Given that the population is expanding, this will naturally increase the requirement for knee and hip replacements. There's also the aging population who tend to need these replacements.

I think the company will benefit in the long run and management seems focused on the task of improving its earnings growth. The product lineup from the company includes an array of medical products, including dental. While the younger population nowadays have healthy teeth, this is not the case with the older population where tooth decay is a major problem that cannot be reversed. This older population will require dental products (such as implants) well into the future. This will ensure that Zimmer Biomet's dental products will be in demand for many years to come.

Stock Valuation

Zimmer Biomet has a history of moderate revenue growth and a volatile earnings history since it acquired Biomet. The company could not be considered a growth stock, but if its future growth expected growth materializes then it could possibly be valued as a moderate growth stock using the PEG (PE divided by the earnings growth rate).

The company's CFO gave a 2% to 3% growth figure for 2020 in their earnings call. The analysts had a 6.5% growth rate.

The 2% growth is realistically too low to use for the PEG valuation (it gives a PEG of 8.3 which gives a fair value of only $16).

The analysts have a higher 6.5% growth but the problem with this is that there's no history to back up this growth rate (which means it's highly speculative)

Given that there's no appreciable historical growth, I think it's best not to use the PEG to value the stock. Zimmer Biomet's 2020 forward PE is 15.6x and its current book value is 2.3x. These metrics give me a feel for the stocks value based its $130 stock price. At this price I don't consider the stock expensive, but it's certainly not cheap.

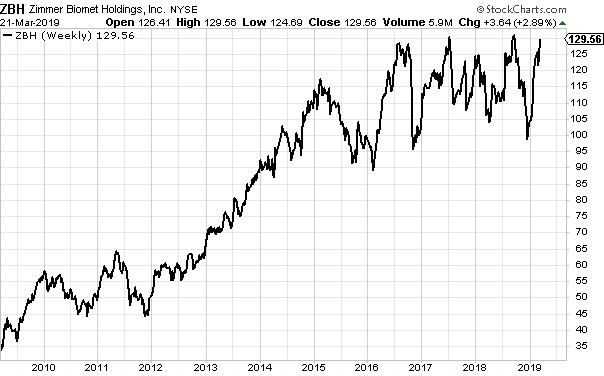

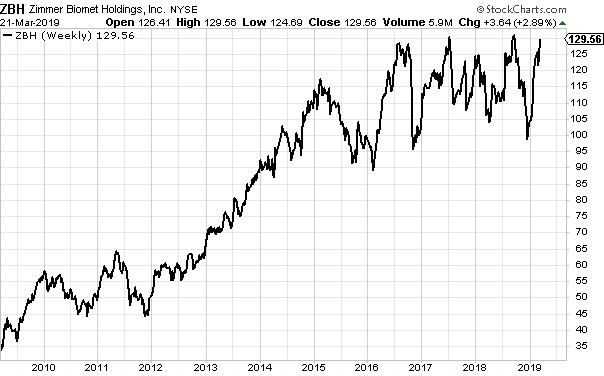

Stock Price

As an active investor I personally like to determine some likely price targets. This gives me a feel for how high the stock price could go in the short term and how soon it could get there.

Zimmer Biomet chart by StockCharts.com

The stock chart reveals that Zimmer Biomet's stock price broadly traded up and essentially traded sideways from 2016. Interestingly it has traded sideways since it acquired Biomet.

The new CEO has being working on improving the company's quality control and supply issues since the start of 2018, but the market didn't respond. I think the stock will likely remain in its trading range until it shows some decent earnings growth.

Over the long term the stock price could trade up, but I think it would only stay there if the company generates earnings growth.

Conclusion

Zimmer Biomet is a company with a history of subdued growth and a volatile earnings history since the Biomet acquisition. The company is introducing new products, having just received FDA clearance for a new knee system using robotics, and has partnered with Apple trialing a new app for knee and hip replacement patients.

Management feels comfortable that the company can generate modest earnings growth going forward. Over the long term the stock price could trade up but I think it would only stay there if the company succeeds in generating its earnings growth.

The stock price is not overly expensive with a forward PE multiple of 15.6x and at book value of 2.3x. Also the stock pays a modest 0.75% dividend.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.